Virtually unheard of since World War I, the single tax was arguably the most contentious issue in Oregon politics during the early twentieth century. The brainchild of reformer Henry George, the single tax involved government appropriation of all "unearned" increases in land values. A concrete example: If Henry Corbett bought a block of land in downtown Portland for $5,000 in 1880 and did not build or improve the lot but it increased in value to $10,000 in 1890, then the extra $5,000 would go straight into the government coffers.

The purpose of the tax was not only to fund government, but even more to encourage development and break up the concentration of wealth in landholding, which single taxers believed was the primary cause of poverty and inequality. It would be a single tax because all other taxes would be abolished.

The single tax came to Oregon as the most important goal for William U'Ren, the chief architect of the Oregon System of initiative, referendum, and recall. U'Ren recruited a number of other radical direct democrats and laborites to help further the single-tax crusade, including C.E.S. Wood, Will Daly, Alfred Cridge, W.G. Eggleston, E.S.J. McAllister, and H.D. Wagnon.

While U'Ren was spectacularly successful with many of his proposals for direct democracy, he did not achieve nearly as much with the single tax. He and his allies put different versions of the single tax on the Oregon ballot at every election between 1908 and 1916 (different activists placed single-tax initiatives on the ballot in 1920 and 1922). The only time single taxers won was in 1910, and that came with a watered-down proposal that many claimed was unclear to voters. Otherwise, Oregon voters decisively rejected single-tax proposals.

The lopsided electoral defeats, however, do not reflect the storm the single-taxers caused in Oregon politics. The state's economic elites, who had gained much of their fortunes from real estate, considered the single-taxers to be dangerous radicals, and they fought the single tax as if it was an attack on civilization itself. In turn, the single tax gained considerable support among workers and small business owners, especially in Portland. They believed that the tax represented the last chance to make Oregon an egalitarian economic paradise of truly independent homeowners. This strain of economic populism would change significantly over the next hundred years, but it would continue to powerfully influence the state's many battles over taxation.

-

![]()

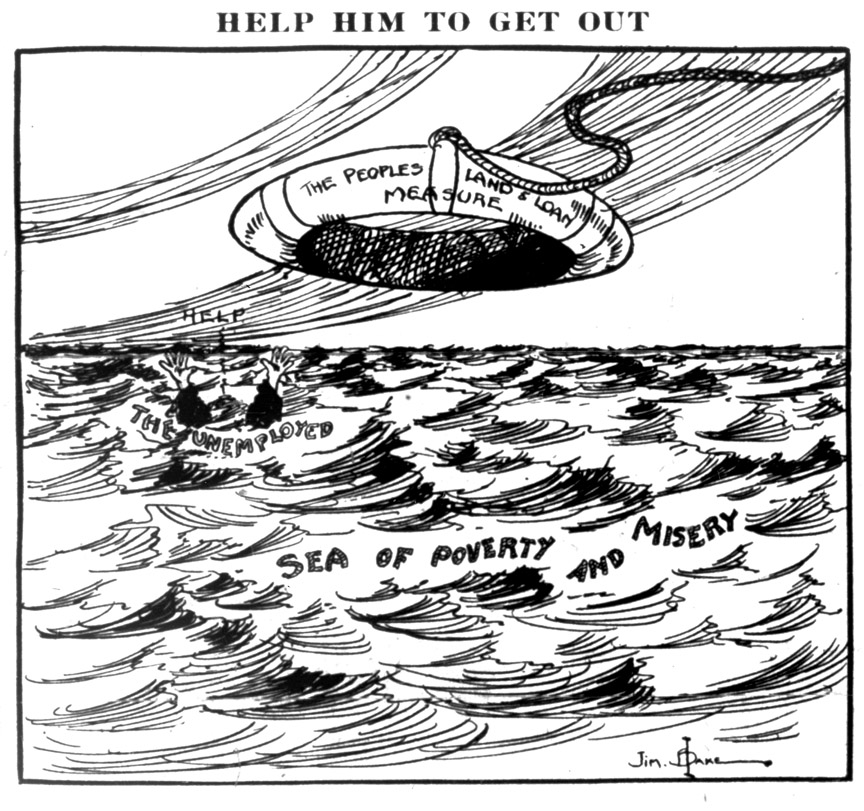

Oregon Labor Press cartoon in favor of the Single Tax: "Help Him to Get Out," 1916.

Oregon Historical Society Research Library, bc0065923

-

![]()

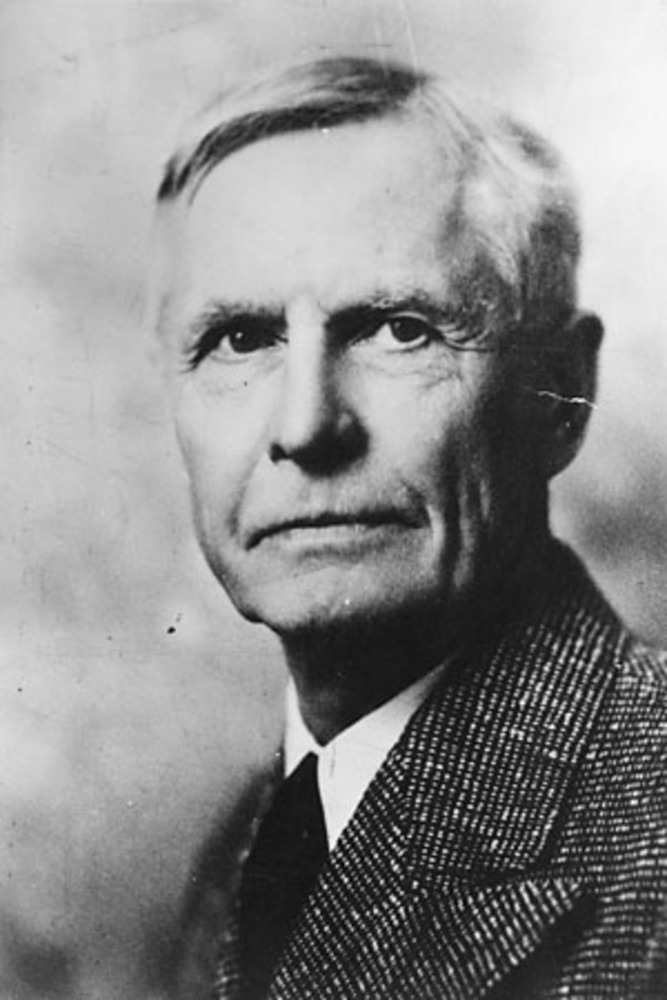

William S. U'Ren, 1946.

Oreg. Hist. Soc. Research Lib., CN 01831

Related Entries

-

![Measure 5 (property taxes)]()

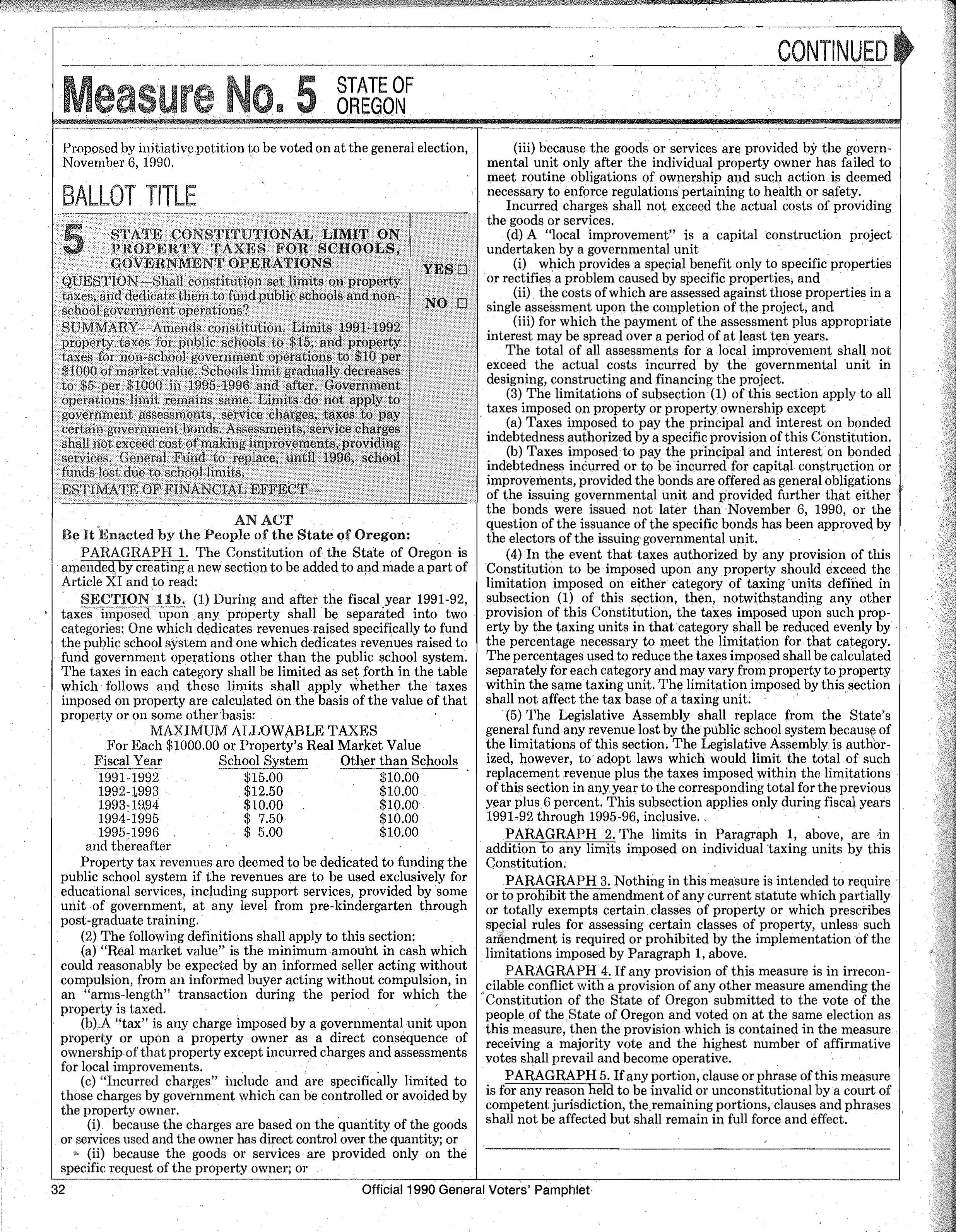

Measure 5 (property taxes)

Ballot Measure 5, an initiative passed by Oregon voters in November 199…

-

![William S. U'Ren (1859–1949)]()

William S. U'Ren (1859–1949)

William S. U’Ren wielded enormous influence on American politics and pl…

Related Historical Records

Map This on the Oregon History WayFinder

The Oregon History Wayfinder is an interactive map that identifies significant places, people, and events in Oregon history.

Further Reading

Lawrence M. Lipin, Workers and the Wild: Conservation, Consumerism, and Labor in Oregon, 1910-1930. Urbana:University of Illinois Press, 2007.

Robert D. Johnston, The Radical Middle Class: Populist Democracy and The Question of Capitalism in Progressive Era Portland. Princeton: Princeton University Press, 2003.